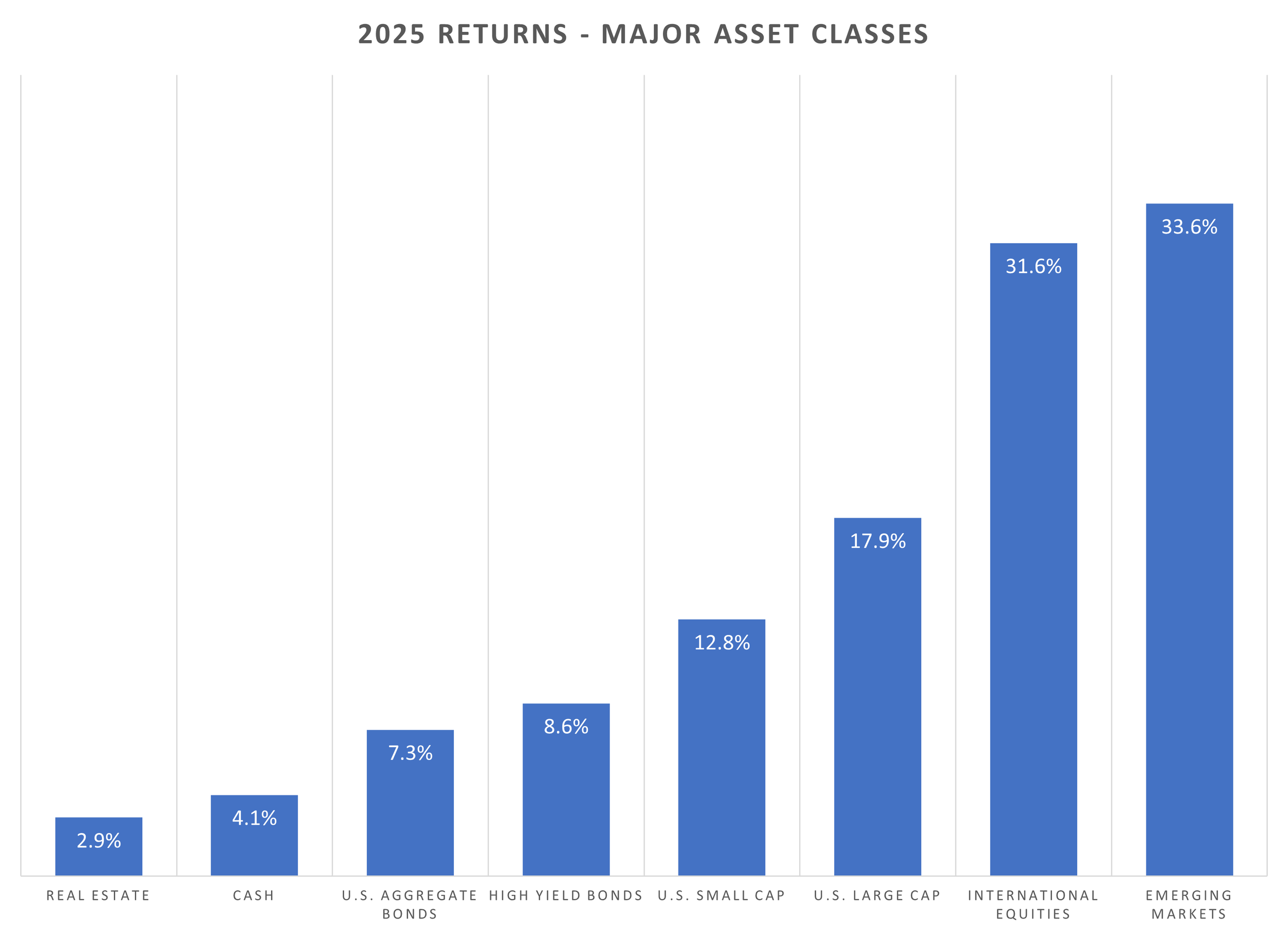

We can now say it: 2025 was a remarkable year for investors. All major asset classes delivered positive returns, from stocks and bonds to cash. Nearly every corner of the investment landscape posted gains—something we haven’t seen in quite some time.

The table below summarizes how different assets performed in 2025, ranging from safe 90-day Treasury bills to riskier emerging-market stocks.

Real Estate – Dow Jones Composite REIT Index TR; Cash – 90-day T-Bill; U.S. Aggregate Bonds – Bloomberg U.S. Aggregate Bond Index; High Yield Bonds – Bloomberg U.S. Corp High Yield; U.S. Small Cap – Russell 2000; U.S. Large Cap – S&P 500; International Equities – Morningstar Global Markets ex-US; Emerging Markets – MSCI Emerging Markets

A Strong Year That Didn’t Feel Easy

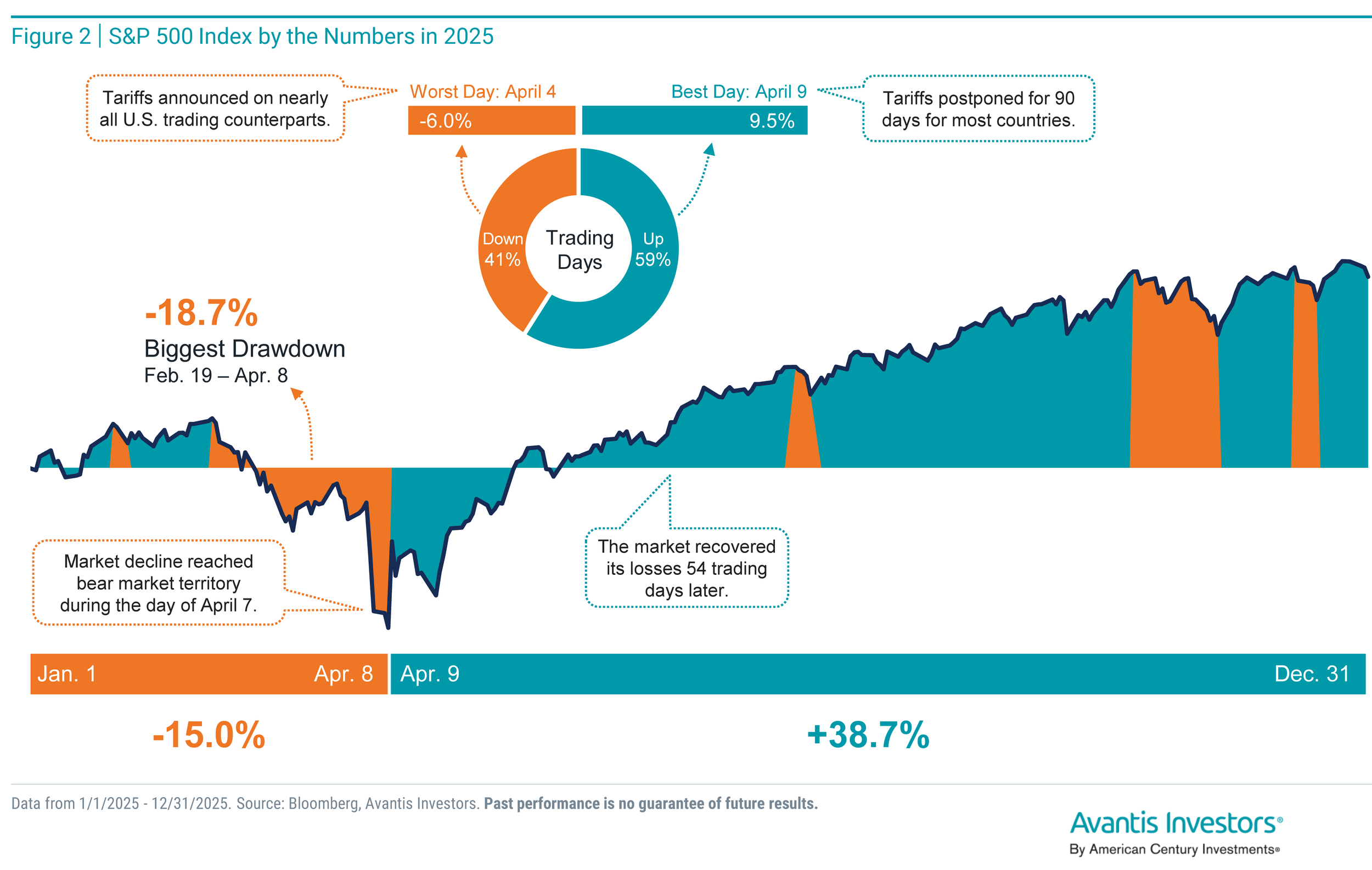

As strong as the final results were, the path through 2025 was anything but smooth. By early April, the S&P 500 Index had fallen roughly 16% amid economic uncertainty and a resurgence of trade tensions. The decline appeared to confirm investor concerns that the post-pandemic market gains had run their course, prompting many investors to exit the markets altogether.

From that April low, however, markets rebounded. The S&P 500 advanced through the remainder of the year and reached new highs by November. As the chart below illustrates, investors who stayed the course through the downturn were well rewarded.

Including dividends, the S&P 500 finished 2025 up approximately 17%. That followed gains of more than 25% in both 2023 and 2024, making this the first time since the late 1990s that U.S. stocks delivered three consecutive years of returns above 15%.

The good years in the market rarely feel easy, though. And periodic volatility often tempts investors with market-timing strategies or familiar myths such as “sell in May and go away.” 2025 served as a useful reminder that, for long-term investors, patience and discipline matter far more than prediction.

Market Concentration Shifted

One of the defining features of recent years has been market concentration: a small group of stocks driving a disproportionate share of returns. In 2023 and 2024, the so-called “Magnificent Seven” dominated market performance.

In 2025, returns were once again driven by a narrow group of stocks, but the specific leaders changed. Of the Magnificent Seven, only Alphabet and Nvidia outperformed the index in 2025; the rest delivered more modest results. As one commentator put it, the “Magnificent Seven” became the “Magnificent Two.”

Nevertheless, 2025 marked the third consecutive year in which fewer than one-third of S&P 500 stocks outperformed the index, one of the narrowest leadership stretches on record. What replaced the Mag Seven? The new winners were tied largely to the same underlying theme: artificial intelligence. Companies involved in chip manufacturing, data centers, and AI-related software benefited from sustained investment and growing demand.

Narrow market leadership can make it tempting to concentrate portfolios around whatever appears to be working best at the moment. However, concentration can backfire as leadership shifts and new areas of the market begin to outperform. By contrast, one of the overriding advantages of a diversified portfolio is that its success does not depend on guessing who will be this year’s winners.

International Markets Finally Took the Lead

After more than a decade of U.S. dominance, 2025 marked a significant turn for international equities. Developed markets outside the U.S. outperformed the S&P 500 by a wide margin, with emerging-market stocks returning almost 34%, while international small-value stocks delivered 38% in U.S. dollar terms.

Gains across Europe, Asia, and emerging markets were fueled by a combination of attractive valuations, a weaker U.S. dollar that boosted returns for dollar-based investors, and improving economic conditions outside the United States.

As a result, 2025 marked a pause and even a modest reversal in a long-running trend in global market leadership. For more than a decade, the U.S. steadily increased its share of global stock market value and by 2024 represented roughly 65% of global equity market capitalization.

Source: Lord Abbett

One consequence of this sustained dominance has been increasingly elevated U.S. stock valuations, leading some observers to anticipate a decline in U.S. stock prices. What made last year’s shift notable is that it occurred not because U.S. stocks struggled – they posted solid returns in 2025 – but because of stronger-than-expected performance abroad.

It was another reminder that long-standing trends can begin to change in ways that are difficult to anticipate, particularly when recent history makes them appear inevitable.

Bonds Delivered the Stability They’re Meant to Provide

Bonds also had a solid year in 2025 with the Bloomberg U.S. Aggregate Bond Index returning roughly 7% for the year. High-yield bonds performed even better, with total returns in the 8–9% range.

With inflation beginning to cool and the Federal Reserve keeping short-term rates near their peak, longer-term yields moved modestly lower in the second half of the year. Bond investors benefited from steady income, modest price gains, and low default rates, reflecting a more optimistic view of global economic conditions than much of the news commentary suggested. In portfolios, bonds once again provided both income and ballast, helping to dampen the volatility of stocks.

The Temptation and Risk of Cash

Cash and cash equivalents had another strong year. Money market yields hovered around 5%, the highest level in roughly 15 years.

Understandably, many investors found the appeal of a “safe” 5% return compelling, particularly during periods of market volatility. Throughout the year, we had conversations with clients weighing the comfort of cash against the benefits of staying invested.

Our guidance was that cash is excellent for short-term needs and stability, but it is not a long-term growth asset. Over time, cash tends to barely outpace inflation, while diversified stock portfolios compound wealth at a much higher rate.

The strong equity returns of 2025 underscored this point. Investors who moved to the sidelines early in the year missed out on substantially higher gains elsewhere. In doing so, they were reminded that attempts to avoid one form of risk can create another, namely missed opportunities.

Looking Ahead

So where does that leave us?

2025 was a year worth celebrating for investors. U.S. investors did well, but globally diversified investors did even better. Investors with exposure across bonds and global equities enjoyed equity-like returns with far less volatility and risk than an all-equity portfolio. These results reinforced timeless lessons: stay invested through uncertainty, diversify broadly, rebalance with discipline, and resist the urge to chase what worked most recently.

As we move into 2026, we face familiar uncertainties: the timing and pace of potential Federal Reserve rate cuts, the durability of economic growth, and ongoing geopolitical risks. After three exceptional years for stocks, it would not be surprising to see more moderate returns or continued volatility.

The challenge is not knowing precisely what comes next, and the remedy remains the same: keep sufficient cash on hand for the near term and hedge your bets through a globally diversified portfolio that is exposed to different sources of return, varied economic conditions, and multiple market outcomes.

We will continue to manage portfolios with these principles in mind, maintaining broad diversification, trimming excess exposure where appropriate, and ensuring that each portfolio remains aligned with its intended purpose.