When it comes to Social Security, many people assume there must be a single “right” answer: a claiming age that maximizes the numbers and settles the question once and for all. In practice, it’s rarely that simple.

A 2025 New York Times article explored why the oft-repeated advice to “wait until age 70” works well for some retirees, but not for many others. The piece highlighted stories of people who claimed earlier because of health concerns, burnout, job loss, or simply a desire to enjoy life while they could.

Those anecdotes reflect a broader truth: Social Security decisions aren’t purely mathematical decisions. They’re intertwined with a host of other factors that themselves are subject to considerable uncertainty about how they’ll play out over time. In addition, they’re not just financial decisions, they’re personal choices reflecting different preferences for peace of mind or flexibility, all of which help determine the optimal time for you to claim benefits.

You can’t know in advance how your decision will ultimately play out, but making a considered decision with all relevant information on the table increases the odds that it will be the right one for you.

How Social Security Retirement Benefits Work (The Basics)

Social Security retirement benefits provide inflation-adjusted income for life, based on your earnings history and the age at which you start benefits.

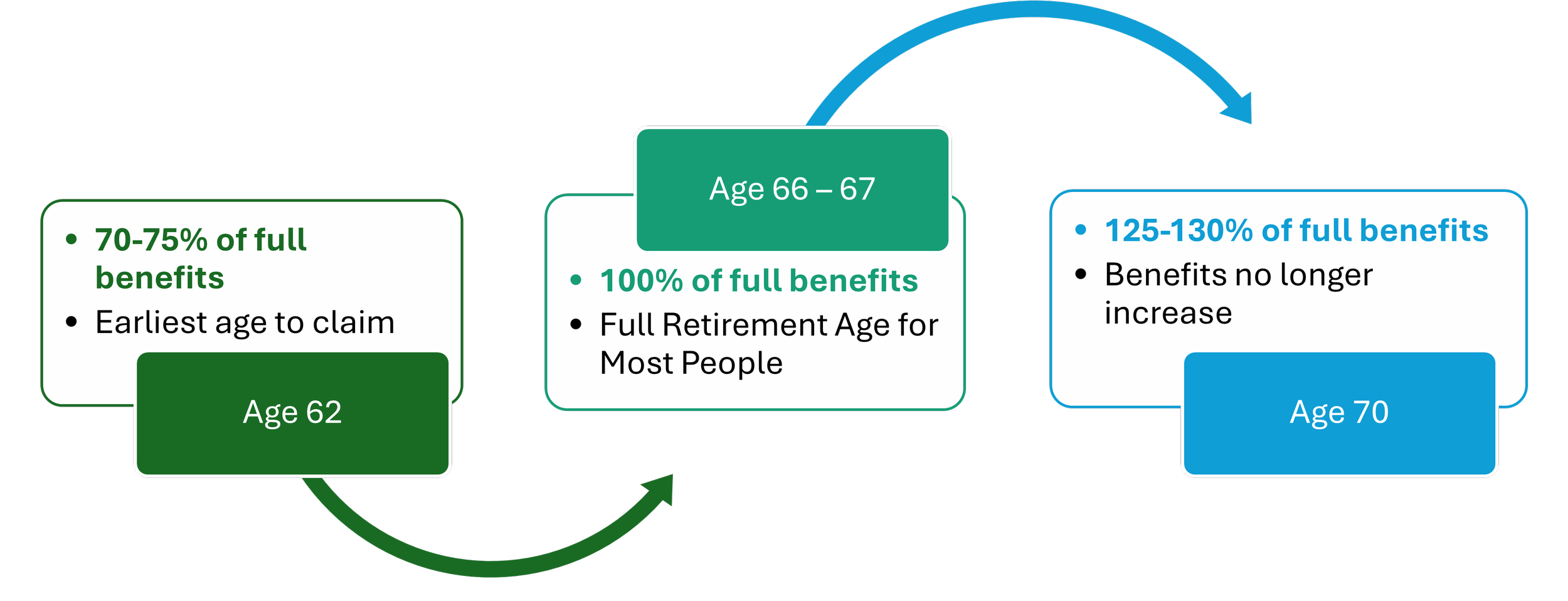

For most people retiring today:

- Full retirement age is 66 or 67.

- Claiming earlier permanently reduces benefits.

- Delaying past full retirement age increases benefits by roughly 8% per year until age 70.

Once benefits start, they continue for as long as you live and typically rise with inflation.

Which leads to another important concept in this discussion.

Social Security as Longevity Insurance

It’s tempting to analyze Social Security through a “break-even” lens: at what age do I receive more after-tax total dollars over my lifetime by waiting?

While that math can be calculated (and is often in one’s early 80s), it’s only part of the story. Social Security combines income replacement, inflation protection, and longevity insurance – i.e., guaranteed income for life – into a single retirement benefit. This benefit protects against the risk of outliving one’s assets, a form of insurance that is widely undervalued and difficult to replicate anywhere else.

For many retirees, particularly those with ample retirement savings, the greatest financial risk doesn’t show up in their 60s or early 70s. It appears much later, when:

- Investment portfolios may be smaller

- Health care costs may be higher

- The ability to return to work is limited

Delaying benefits increases the size of this late-life safety net. That’s why planners often emphasize delaying when circumstances allow – not because it wins a spreadsheet comparison, but because it reduces the risk of running short later in life.

At the same time, not everyone has the health, resources, or desire to delay, and that’s where personal circumstances and priorities matter.

Claiming Social Security - Early or Later?

There are many reasons for choosing to claim Social Security earlier or later, among them:

- Household configuration (how many working spouses, their ages & employment-earnings records)

- Other sources of retirement income such as pensions and investment accounts

- Income-tax profile in retirement

For the vast majority of people who claim Social Security before age 70, common reasons include:

- Health concerns and family history

- Job loss or underemployment

- Burnout or career changes

- A desire to preserve savings or enjoy retirement sooner

These are not irrational choices. For many households, claiming earlier provides flexibility, stability, or simply peace of mind at a moment when it’s needed most. Family histories around longevity, health, or past financial experiences can also shape whether it feels more comfortable to claim benefits earlier or later.

Will Social Security “Run Out of Money”?

An oft-cited reason for claiming retirement benefits early is concern about whether Social Security will still be there in the future.

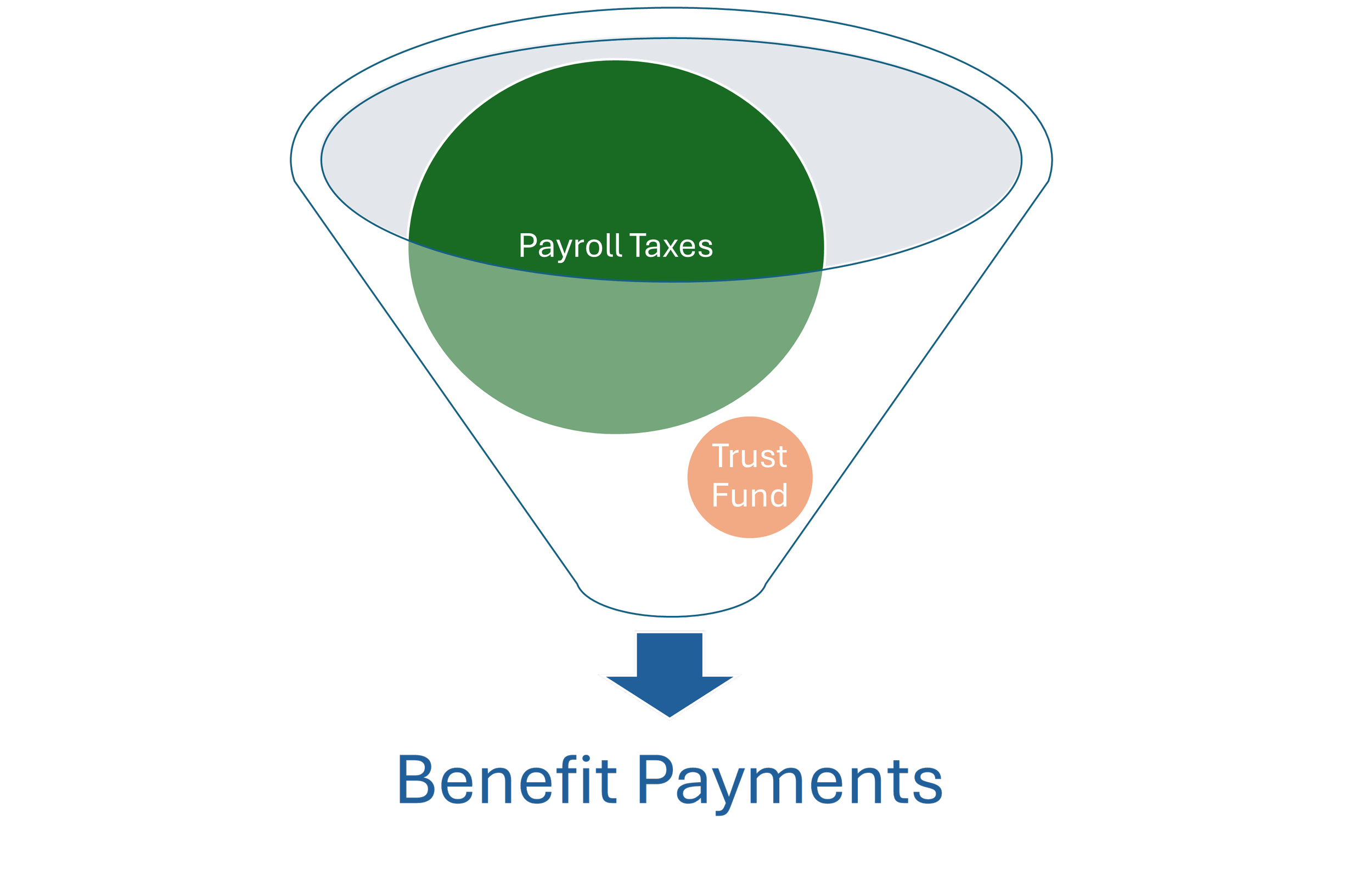

This concern usually stems from annual reports each spring or early summer that “Social Security could run out of money” by the early 2030’s. What’s often missed is the distinction between the primary funding mechanism for Social Security and its supplemental reserve fund – the “Old-Age and Survivor Insurance (OASI) Trust Fund.”

Social Security is primarily a pay-as-you-go system. Payroll taxes collected from current workers are used to pay benefits to current retirees. When tax receipts exceed the benefits being paid to retirees, the excess money goes into the trust fund. When tax receipts are less than benefit payments, the trust fund covers the difference.

From the beginning of Social Security nearly a century ago, the system was designed to be adjusted over time as demographics and economic conditions changed, allowing each generation to adapt the system to evolving circumstances. Past changes, occurring roughly once a decade, have included:

- Benefits were adjusted for inflation

- Full retirement age was gradually increased

- Tax caps and formulas were modified to increase payroll taxes

- A portion of benefits became taxable income for higher-income retirees

The last major changes were made in the early 1980’s, and at that time, it was anticipated that we’d need to make further adjustments in the 21st century. Since then, we’ve received steady reports that the trust fund would likely be depleted in the early 2030’s.

No one wants to hear that their roof will eventually need to be replaced. And typically a homeowner will wait until the last possible minute to reluctantly hire the contractor. This is basically what we saw in the 1980’s - much handwringing and little action until the final hour before political will was marshalled to make the necessary changes.

This makes sense, given that the system is ultimately a negotiation among different generations, each typically asked to make compromises and sacrifices on behalf of the others. To understand this better, you can work to design your own remedy here: An Interactive Tool to Fix Social Security.

We can probably expect more of the same this time around, with some combination of increasing retirement ages, raising payroll taxes, and taxing benefits more. This would be a far cry from the system vanishing entirely – something to consider when tempted to claim benefits early, especially when doing so means permanently giving up a meaningful share of lifetime benefits.

How to Think About Your Own Claiming Decision

Rather than asking, “What’s the optimal age?” we encourage clients to think in terms of trade-offs and personal preferences and to avoid letting a spreadsheet be the only voice in the room.

Questions to consider include:

- How is my health, and how does longevity factor into our plan?

- Do I have other resources to draw on if I delay?

- How important is guaranteed income later in life versus flexibility now?

- How does this decision interact with taxes, portfolio withdrawals, and spousal benefits?

Your answers may differ in important ways from those of friends or family members. In the end, the goal is alignment – among financial goals, available resources, and individual preferences.

Conclusion

Social Security is one of the most valuable, and most misunderstood, components of a retirement plan. Deciding when to claim retirement benefits is not a simple math problem, and it is not a one-size-fits-all decision.

Regardless of when you decide to start your benefits, Social Security provides something rare: inflation-adjusted income you can’t outlive. The key is understanding the trade-offs and making the decision thoughtfully, as part of a broader, realistic plan.